How Stay-at-Home Parents Can Build Good Credit

- Stay-at-home parents should build good credit to access better financial opportunities and to ensure financial independence, especially in case of unexpected life events like divorce.

- Building credit as a stay-at home parent can be achieved through various methods, including secured credit cards, becoming an authorized user on a spouse’s account, credit builder loans, and becoming a joint borrower on major loans.

- Maintaining a good credit score requires consistent on-time payments, minimizing balances, establishing a long credit history, limiting new credit applications, and managing a variety of credit types.

Credit scores are an incredibly important part of your financial life.

They determine whether you will qualify for a loan that you apply for. If you do qualify, your credit will determine the interest rate and fees you’ll have to pay.

But, getting a credit line usually requires income.

If you’re a stay-at-home parent, you might not have a source of income other than your partner’s.

Though it might be harder than it is for most people, stay-at-home parents should still take steps to build their credit.

Why Stay-at-Home Parents Should Build Good Credit

Building good credit is rather straightforward. All you have to do is make on-time payments on your loans and other bills.

So long as you avoid mistakes and don’t take on a lot of debt, you’ll wind up with great credit.

The real trick is getting your first loan.

If you don’t have a credit history, lenders will be hesitant to lend to you. This problem is made even worse for stay-at-home parents. Lenders will want to know that you have income that you can use to pay off the loan.

There are a lot of reasons for a stay at home parent to want to build credit.

Credit cards

The first reason is that you may want to qualify for premium credit cards. As a stay-at-home parent, you most likely do the majority of the shopping for your household.

Many credit cards offer valuable rewards that can help you save money on everyday purchases.

You might want to get multiple credit cards that focus on different categories of spending so that you can earn the most rewards across categories like groceries, department stores, and gas.

Many of the credit cards that offer the best rewards require good credit to get.

If your credit isn’t great, you might not be able to get the cards that offer the best rewards, forcing you to spend more on your everyday purchase.

Joint loans

A couple will often take on a few joint loans, especially for large purchases. The most common example of a large joint loan is a mortgage.

Mortgage lenders will often look at the credit history of everyone whose name is going to be on the title of the house.

This means that if you plan to own the home jointly with your spouse, the lender will be looking at your credit and your spouses.

If your credit scores are very different, it can affect your application.

If just one person on the application has poor credit, it can affect the odds of approval or result in a higher interest rate on the mortgage.

Planning for the worst

While it’s not something that most married couples want to consider, nearly 40% of American marriages end in divorce.

If you and your spouse do get divorced, you want to have some financial self-sufficiency to fall back on.

You’ll have to find a job to cover your expenses, you may need to find a new place to stay and make other large purchases such as a buying car. To do this, there’s a good chance that you’ll need to take on a loan.

Having a good credit score of your own, rather than relying on your spouse’s good credit, will put you in a good position to recover should the worst happen to your relationship.

Can Stay at Home Parents Qualify for a Loan?

You might wonder how a stay at home parent can qualify for a loan if they don’t already have good credit.

Many lenders will consider household income rather than just personal income when making a lending decision.

The idea is that assets in a marriage are joint assets, so you will have access to the money your spouse earns, even if you don’t earn any yourself.

You can report your household income on loan applications that allow it, giving yourself a better chance of qualifying for a loan.

Ways to Build Credit

There are a few ways to start building your credit as a stay at home parent.

Credit Cards

Credit cards are one of the most common lending products in the U.S., and they’re a good way to build credit.

Used responsibly, credit cards can save you money and give your credit score a boost. All you have to do is make sure you can pay your balance off in full each month and your credit score will increase.

You can look for credit cards that will approve you based on household income. You can also apply for a secured credit card.

Secured credit card

For a secured card, you’ll offer some form of collateral, usually in the form of the balance of a savings account or a CD.

The lender will give you a credit limit equal to the value of your collateral. In effect, you get a credit card but the lender takes on no risk.

Over time, your credit score will improve until you can get an unsecured card.

Become an authorized user

You can ask your spouse to add you as an authorized user on one of their credit cards.

Some card issuers report authorized user information to the credit bureaus, which can give your score a boost so long as the account is in good standing.

Personal loans

You can also try applying for a personal loan to start building your credit.

One popular way to build credit is with something called a credit builder loan.

This is a type of secured personal loan that is usually for a small amount that carries a low rate of interest and a short term. You take on the loan and make payments over the course of a year or two.

By the time the loan is paid off, your credit score will have improved.

Be a joint borrower

When you and your spouse take on a major loan, make it a point to be a joint borrower on the loan.

For example, being a joint borrower on your mortgage can give your score a boost.

Each payment will be added to your credit report. So long as your stay on top of your mortgage payments, your score will improve.

What Credit Score to Aim For

Your credit score is a numerical indication of your trustworthiness as a borrower.

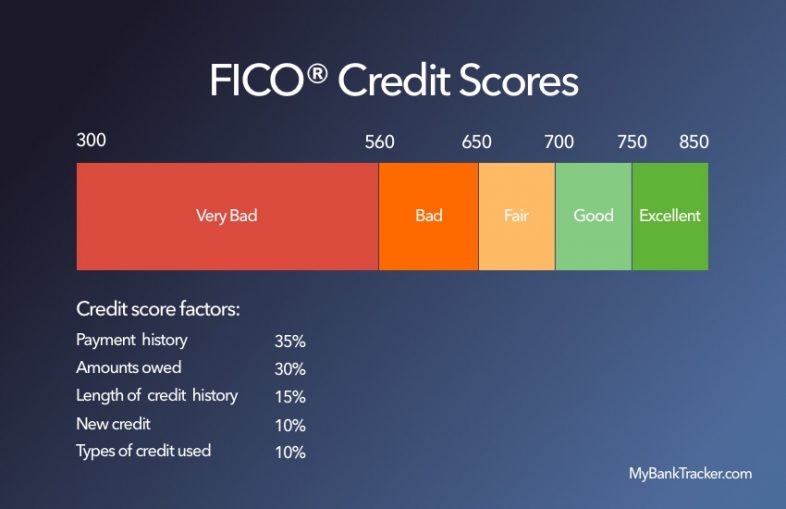

Your score can range from as low as 300 to as high as 850. Of course, you want to have a score that is as high as possible.

You should aim for a credit score of at least 700. This will give you access to the vast majority of loans and credit cards.

It will also get you reasonable rates on the loans you do qualify.

While you might not be able to get the most premium lending products, you’ll be able to qualify for the ones you need to get by.

How Credit Scores are Calculated

Your credit score is calculated from five factors:

- Payment history

- Amount owed

- Length of credit history

- New credit

- Types of credit used

Your payment history is the most important part of your credit score.

Having a history of making on-time payments is the best way to wind up with a good credit score. Having just one late or missed payment can cause a huge drop in your credit score.

The amount that you owe is the next most important factor in your credit.

You want to owe as little as possible to make sure your score stays high. When it comes to credit cards, aim to use as little of your credit limit as possible. As you get closer to maxing out your credit cards, your score will drop.

The length of your credit history also plays a role in your score’s calculation.

The longer you’ve had access to credit, the more information lenders will have to look at when they’re making a lending decision. That’s why it’s important that you start early when it comes to building credit.

Your new credit lines and the types of credit used both have small effects on your score.

Lenders see it as a red flag if someone applies for a lot of loans in a short amount of time.

They also like to see someone who can handle multiple different types of debt, such as credit card debts, mortgage debt, or personal debt. The more types of debt you have experience with, the better you will be at managing new loans.

Conclusion

Because of how important credit scores are in this day and age, stay at home parents should take the time to make sure they have a good credit score.

It can help them save money on everyday purchases, qualify for large joint loans, and give them a fallback plan should their relationship end.