How Do Student Loans Affect Your Credit Score?

If you have student loans you may be feeling totally overwhelmed by the task of repaying them. That’s normal! Student loans are a big responsibility.

Don’t panic! Exploring the ins and outs of student loans is also totally normal. It’s always a good idea to educate yourself on how your loans are impacting your financial health.

You may have also realized that student loans affect other different areas of your financial landscape. One part of your financial landscape you may not have considered is your credit score. Can student loans affect your credit score? How exactly do they affect your score? What can you do to help your score?

Quick answer: Yes, your student loans definitely have an impact on your credit score — just like any other line of credit.

To understand how everything is connected, let’s start by diving into the basics of student loans and credit scores.

What Are Student Loans?

Student loans represent a contractual agreement between a lending institution and a borrower.

In this agreement, a lender agrees to issue a predetermined sum of money to a borrower with the understanding that the borrower will repay the sum within a certain time (and almost always with interest).

Student loans are used for payment of educational expenses, such as tuition, educational material costs, and campus housing.

Though student loans are most often taken out by the student whose education needs funding — special kinds of student loans can also be taken out by parents or co-signers.

If you have student loans, you’re definitely not alone. 44.2 million Americans are in the same boat.

There are two main types of student loans:

1. Federal Student Loans

Federal student loans are funded by the Department of Education and carry a fixed interest rate. This rate will not exceed the federal max. Federal student loans include Stafford Loans and Perkins Loans and can be subsidized or unsubsidized.

Federal Student Loans

| Loan Name | Description |

|---|---|

| Direct Subsidized Loans | Loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education at a college or career school. |

| Direct Unsubsidized Loans | Loans made to eligible undergraduate, graduate, and professional students, but in this case, the student does not have to demonstrate financial need to be eligible for the loan. |

| Direct PLUS Loans | Loans made to graduate or professional students and parents of dependent undergraduate students to help pay for education expenses not covered by other financial aid. |

| Direct Consolidation Loans | Loan that allows you to combine all of your eligible federal student loans into a single loan with a single loan servicer. |

| Federal Perkins Loan Program | School-based loan program for undergraduates and graduate students with exceptional financial need -- under this program, the school is lender. |

2. Private Student Loans

Private student loans, or private education loans, are provided by non-governmental lending institutions. It’s important to take extra heed when taking out these types of loans.

Private lending institutions can be reputable, but they don’t always come with the same protections afforded by federal student loans.

For example, private loans often carry variable interest rates or fixed interest rates. A variable interest rate indicates that the interest rate may change over time.

This could sound appealing if the starting interest rate is lower than the fixed federal interest rate. By nature, however, a variable interest rate also has the potential to soar far above the federal limit, resulting in higher monthly interest payments.

Whatever type of student loan you choose to take out, it’s important to remember that student loans cannot be discharged in bankruptcy. They are considered “sticky” debt and will stay with you up to the bitter end.

It’s crucial when taking out student loans that you consider what type of repayment plan will be feasible in the future and to take out the least amount of student loan debt possible. The less you take out initially, the less you pay back later.

Now that we know more about student loans let’s move on to deciphering the basics of a credit score.

Some Student Loan Providers

| Lender | Borrowing Amounts | Available Terms | Eligible Loans For Refinancing |

|---|---|---|---|

| Citizen's Bank | $10,000 to $90,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| Discover Bank | $5,000 to $150,000 | 10- and 20-year terms | Both Private loans and Federal loans |

| CommonBond | $1,000 to $500,000 | 5-, 7-, 10-, 15-, and 20-year terms (Hybrid Rate loans are only available for 10-year terms) | Both Private loans and Federal loans |

| Wells Fargo | $5,000 to $120,000 | 5-, 10-, 15-, and 20-year terms | Only Private loans |

| SoFi | $5,000 to the amount your schooling costs | 5-, 7-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

| PNC | $10,000 to $75,000 | 10-, and 15-year terms | Both Private loans and Federal loans |

| Earnest | $5,000 to $500,000 | 5-, 10-, 15-, and 20-year terms | Both Private loans and Federal loans |

All About Credit Scores

Credit scores are used by lenders to measure the “creditworthiness” of a borrower. Lenders assume a higher credit score will be a positive indicator of a borrower’s financial trustworthiness and reliability.

That assumption, of course, is not always the case. Some borrowers with a high credit score can have less than ideal financial habits and some borrowers with a lower credit score have impeccable financial habits.

Regardless, it’s a good idea to maintain a higher credit score as opposed to a lower one. Consumers with a high credit score often benefit from lower interest rates and a greater likelihood of approval for credit.

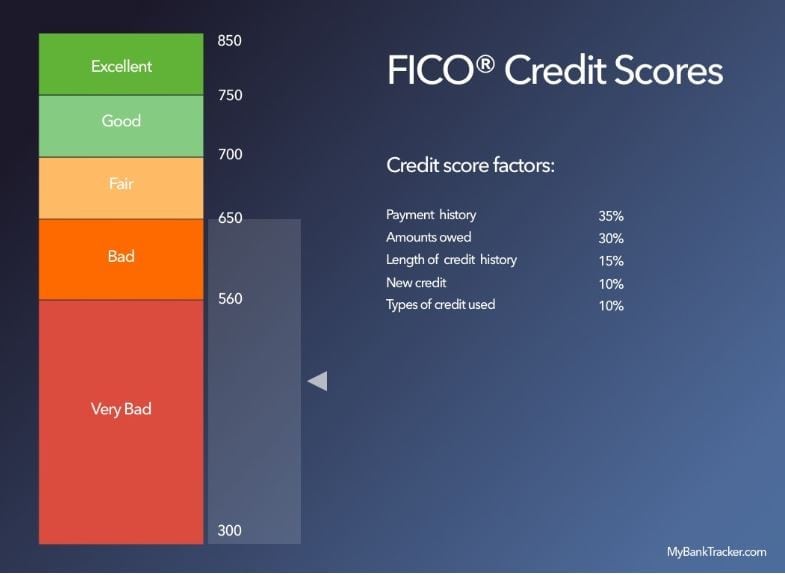

The most commonly used credit score is the FICO credit score. FICO credit scores are used by more than 90% of major U.S. lenders.

A FICO credit score is built up over time by aggregating a consumer’s financial data and calculating this information based on a formula.

While the exact formula for calculating credit scores is hidden from the consumer, we do know the five factors which affect your credit score. They are:

FICO Credit Score Factors and Their Percentages

| FICO credit score factors | Percentage weight on credit score: | What it means: |

|---|---|---|

| Payment history | 35% | Your track record when it comes to making (at least) the minimum payment by the due date. |

| Amounts owed | 30% | How much of your borrowing potential is actually being used. Determined by dividing total debt by total credit limits. |

| Length of credit history | 15% | The average age of your active credit lines. Longer histories tend to show responsibility with credit. |

| Credit mix | 10% | The different types of active credit lines that you handle (e.g., mortgage, credit cards, students loans, etc.) |

| New credit | 10% | The new lines of credit that you've requested. New credit applications tend to hurt you score temporarily. Learn more about FICO credit score |

These five factors are combined and crunched to determine your credit score. The FICO score may range from 300–850.

You can check your credit score in several ways. Many banks and credit card lenders are beginning to include a consumer’s credit score in their monthly statement. Poke around your financial services site to figure out if yours can be made available to you.

Credit Score Ranges and Quality

| Credit Score Ranges | Credit Quality | Effect on Ability to Obtain Loans |

|---|---|---|

| 300-580 | Very Bad | Extremely difficult to obtain traditional loans and line of credit. Advised to use secured credit cards and loans to help rebuild credit. |

| 580-669 | Bad | May be able to qualify for some loans and lines of credit, but the interest rates are likely to be high. |

| 670-739 | Average/Fair | Eligible for many traditional loans, but the interest rates and terms may not be the best. |

| 740-799 | Good | Valuable benefits come in the form of loans and lines of credit with comprehensive perks and low interest rates. |

| 800-850 | Excellent | Qualify easily for most loans and lines of credit with low interest rates and favorable terms. |

You may also monitor your credit score using services like Credit Karma. Keep in mind that services like these will give you a general view of your credit score, but they may not provide a score that is 100% accurate.

Lastly, you can check your credit report for free up to three times per year.

Your report doesn’t include your credit score, but it does include your payment history and will give you insight into positive or negative marks on your credit, such as late payments or low credit utilization.

You can access your credit report once every 12 months from each of the main credit bureaus: Equifax, Experian, and TransUnion.

How Student Loans Affect Your Credit Score

Student loans do have an affect on your credit score, though not in all the ways other loans (like credit card debt) will.

Student loans are considered installment loans, meaning monthly payments are required and tracked.

If you can keep up a great payment cadence and avoid any late payments, then you demonstrate responsibility to lenders. This will have a positive effect on your credit score.

As frustrating as having student loan debt might be, there are some positives to come out of it. By having student loans you are adding age to your accounts, increasing credit utilization, and diversifying your credit mix, therefore actually helping your credit score.

Alternatively, student loan debt also has the power to lower your credit score.

Late payments for these types of loans will be marked on your credit report. When a payment is more than three months (90 days) late, the loan is considered delinquent.

This negative mark will remain on your report for seven years. If a payment is more than nine months (270 days) late, the loan is considered to be in default.

If you are seriously struggling to pay back your student loans, consider deferment or forbearance. This will help you to manage your monthly payments, while preserving your credit score.

Delinquent or default marks on your credit report can affect your ability to take out new loans or cause interest rate to increase in the future.

Conclusion

As with any loans, student loans shouldn’t be taken lightly. Only take out an amount you know you can pay back and be vigilant in making your payments on time.

This will help to bolster your credit score while you repay your debt.

If you’re struggling to pay your monthly bill, speak with your lender sooner rather than later. They may be able to help you create a payment plan that works for you.

You may benefit from federal repayment programs designed to help non-profit professionals and educators to forgive a portion of their debt after certain criteria are met. These specialized repayment programs are available to Federal student loan borrowers.

Student loan refinancing is also beginning to take hold. This option is something to explore if you work with a reputable company and meet the strict requirements needed to refinance.

Keep in mind, refinancing requires a soft credit check which may give your credit score a small, temporary hit.

Finally, take care to avoid companies that promise to eliminate student loan debt. As nice as they sound, these are often predatory companies with ulterior motives.

Estimated Interest Personal Loan Calculator

Student Loan & Credit Score FAQs

Still hungry for information? Below you’ll find a few commonly asked questions.

Q: What happens to your credit score as you pay down your student loan debt?

A: Your credit utilization will drop, and the age of your loan grows. These are good factors for your credit score.

Q: What happens to your credit score when you pay off your student loan debt?

A: The age of your loan stops accruing years and the loan is closed. This may cause a slight dip in your score once you pay it off.

Q: What happens to your credit score if you’re late on a student loan payment?

A: Your credit score may take a hit. Payments that are paid within 90 days will not be reported. Those surpassing 90 days will be marked on your credit report. Negative marks will remain on your credit report for 10 years and may affect your ability to get a loan in the future or result in higher interest rates for future loans.

Q: Should you delay paying off student loan debt to avoid lowering your credit score?

A: No. Your payment history and account age still play a positive role in your credit score. Paying off your student loan debt will help you financially in the long run! Once your student loans are paid off, you can begin funneling payments into your retirement or emergency funds.