4 Ways to Earn More Chase Freedom Cash Back Rewards

Chase Freedom is one of the popular credit cards that is often noted for its attractive cash back cash back program.

The card offers 5% cash back on certain categories that change every three months during the calendar year. All other spending will earn a base 1% cash back rate.

Chase provides a general idea of what these categories will be for each quarter of the year. The specific categories for the next quarter are usually announced one month before the current quarter ends.

(Note: Only the first $1,500 spent in the 5% cash back categories will earn that cash back rate for that quarter. So, that’s a maximum of $75 cash back earned under the 5% cash back categories per quarter. You can earn unlimited 1% cash back.)

Read Chase Freedom Credit Card Editor’s Review

It’s a good idea to look over the cash back calendar early in the year, just so you can plan any major purchases to earn the most cash back.

Below, you’ll find a few more tips to help you use the card smarter:

Enroll Early So You Don’t Forget

With service, you must remember to enroll every quarter in order to earn 5% cash back in these categories.

It might seem annoying to have to sign up every 3 months — you’d expect to be “enrolled” automatically.

Chase explains that the enrollment requirement is actually a good thing because it reminds you to take advantage of the extra cash back.

One good thing is that the categories are usually quite appropriate for the season.

Even if you don’t think that you’ll be spending in those categories for the quarter, sign up anyway. You’ll never know if you’ll shop somewhere that lets you earn 5% cash back unexpectedly.

You can enroll through several ways. The easiest way to enroll is through the one-click activation email that Chase sends as a reminder.

It really does require just a single click — no need to log in. Other ways include online banking and at a Chase ATM.

Chase Freedom doesn’t punish those who forget

One very unique aspect of the is its cash-back enrollment policy.

Other similar credit cards such as Discover it and Citi Dividend will require cardholders to enroll before they can begin to earn the 5% cash back.

Chase Freedom, on the other hand, is very forgiving. It lets you sign up as late as two weeks before the end of the quarter.

All eligible purchases made in that quarter will earn the bonus cash back retroactively. So, when you enroll, Chase will still award the 5% cash back on past purchases, as long as they qualify and were made in that quarter.

It’s nice knowing that you can still enroll later and not miss out on the extra cash back that you deserve.

Buy Gift Cards at Grocery Stores

One very common 5% cash back category on the credit card is “grocery stores.” For many people, it’s a great cash back category because it’s a typical recurring expense.

Also, you can buy branded gift cards at grocery stores.

Commonly found near the checkout aisles at grocery stores, you’re likely to find gift cards for your favorite retailers (e.g., Amazon.com, Apple iTunes, Best Buy, The Gap, etc.).

If you buy them, they’re still counted as grocery store purchases, which allow you to earn the 5% cash back.

The 5% cash back category simply has to match the category of the merchant. It does not matter what you buy. It matters where you buy.

Tip: Gift cards are also sold at drug stores, electronics stores, department stores and more. These retailers are likely to sell branded gift cards and these retailer categories may also show up on Chase Freedom’s 5% cash back calendar.

How to check a store’s merchant category

You won’t always know a store’s category immediately. And, you might not make a big purchase unless you are absolutely sure that you’ll earn 5% cash back. Fortunately, there are ways that you can check a merchant’s category:

- Ask a store manager or cashier. Usually, these store employees will know the merchant’s category.

- Make a small test purchase. You can buy a low-priced item and then check your transaction history, which will show you the retailer’s merchant category.

- Use the Visa supplier locator tool. This is a public, free online database of the merchants that accepts Visa cards — along with their merchant codes.

You might discover new merchants where you can earn cash back. More importantly, you could find merchants that don’t actually pay as much cash rewards as you believe.

Boost Your Cash Back With the Chase Ultimate Rewards Shopping Portal

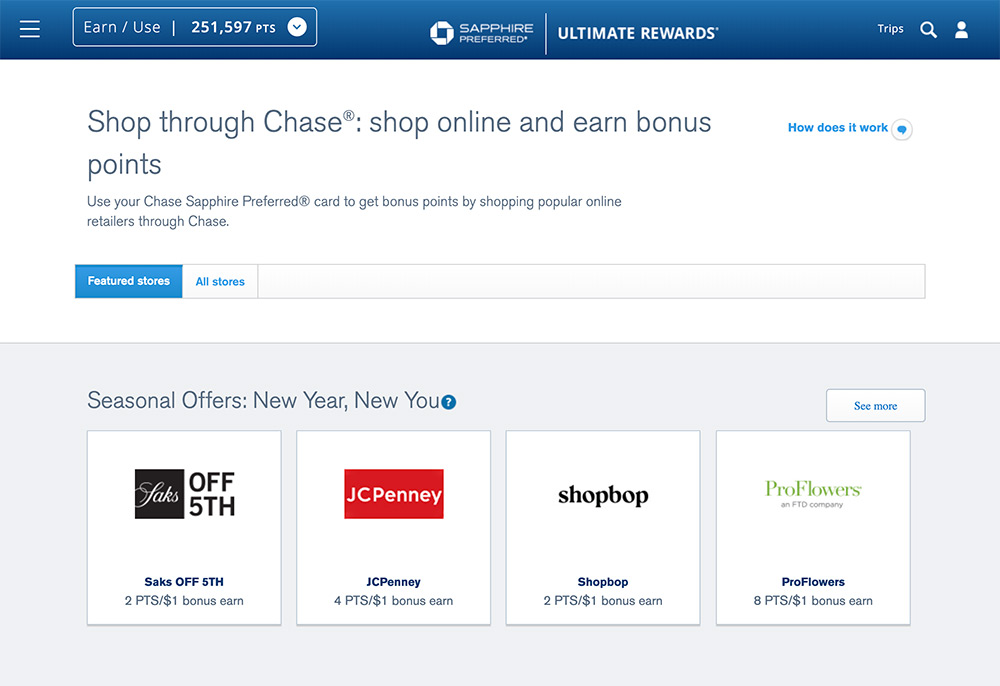

Chase Ultimate Rewards, the name of the rewards program for Chase Freedom, also has an online shopping portal that lets you earn bonus cash back on top of the 5% cash back from your card.

You’ll be surprised at how much extra cash back you can rack up if you shop online through Chase Ultimate Rewards.

For instance, you can earn 5% bonus cash back when you shop at Saks.com through Chase Ultimate Rewards.

For instance, Chase Freedom will typically offer 5% cash back at department stores during one of the quarters. (Saks.com is considered a department store.)

Pay with the Chase Freedom card with the activated 5% cash back at department stores and you’ll earn a total of 10% cash back. That’s a large amount of cash back for shopping at a store that sells luxury goods.

Of course, department stores are just one example. Throughout the year, there could be other categories that would work well with retailers in the Chase Ultimate Rewards program.

Therefore, you should always check Chase Ultimate Rewards to see if you can get any extra cash back (see other ways to get more from Chase Ultimate Rewards).

Whether you’re earning 5% cash back or just the regular 1% cash back, it’s a smarter way to use your Chase Freedom card to save more money.

Note: Chase limits 5% cash back earnings to the first $1,500 in combined spending on the 5% cash back categories per quarter. However, the bonus cash back from Chase Ultimate Rewards does not count towards this limit.

Cash Back Worth More with Chase Sapphire Preferred and Chase Sapphire Reserve

For Chase Freedom credit card customers that also have the or , their “cash back” can be worth more.

The cash back earned through Chase Freedom is recorded as points in Chase Ultimate Rewards.

Each point is worth one cent in cash back. However, these points can be transferred between Chase credit card accounts, including Chase Sapphire Preferred or Chase Sapphire Reserve.

Read Chase Sapphire Preferred Card Editor’s Review

These two cards have special features that can allow you to get more value from your Chase Ultimate Rewards points.

Read Chase Sapphire Reserve Card Editor’s Review

Discounted Chase travel rewards

The rewards program offers a travel booking tool that lets you redeem your points for free travel. Eligible travel redemptions include airfare, hotels, car rentals, and cruises.

With these two cards, you get additional points when redeeming travel through Chase:

Chase Travel Rewards Bonus - Chase Sapphire Preferred vs. Chase Reserve

| Card | Chase Sapphire Preferred | Chase Sapphire Reserve |

|---|---|---|

| Travel redemption bonus | 25% | 50% |

| Bonus points on 50,000-point redemption | 12,500 | 25,000 |

| Total travel rewards value on 50,000 points | $625 | $750 |

Essentially, you’re going to spend fewer points to redeem for travel through Chase.

It is still important to research if the Chase travel rewards will actually come out cheaper than other options. With the large points bonuses from these two Chase Sapphire cards, you might be able to get the cheapest deal.

Transfer to partnered airlines and hotels

Another great feature of Chase Sapphire Preferred and Chase Sapphire Reserve is the ability to transfer your points to various airline and hotel loyalty programs.

There is no fee to transfer points and the points are transferred at a 1:1 ratio.

Chase Ultimate Rewards points can be transferred to the following frequent traveler programs:

- United MileagePlus

- Southwest Airlines Rapid Rewards

- British Airways Executive Club

- Virgin Atlantic Flying Club

- Korean Air SKYPASS

- Singapore Airlines KrisFlyer

- Flying Blue AIR FRANCE KLM

- Hyatt Gold Passport

- Marriott Rewards

- IHG Rewards Club

- The Ritz-Carlton Rewards

The travel rewards through these programs can vary greatly. Therefore, it’s difficult to determine an exact value of your points when they’re transferred.

You may be able to get more than the base value of 1-point-per-1-cent by moving your points to a different program.

Chase Credit Card Comparison

| Credit Card | Cash Back | Travel | Balance Transfer |

|---|---|---|---|

| Chase Sapphire Reserve | N/A - travel card | Get $300 annual travel statement credit, lounge membership, and 3X points on travel and dining | No intro 0% APR offer |

| Chase Sapphire Preferred | N/A - travel card | Earn bonus miles on travel and dining that can be transferred to partnered airline and hotel programs | No intro 0% APR offer |

| Chase Freedom® | Earn 5% cash back on categories that change every quarter | N/A - cash back card | Intro offer available |

| Chase Freedom Unlimited® | Earn 1.5% cash back on all spending. | N/A - cash back card | Intro offer available |

| Chase Slate® | N/A - not a rewards card | N/A - not a rewards card | Intro offer available |

Summary

For a credit card with no annual fee, there’s plenty of cash back potential with the Chase Freedom.

Knowing these cash back tips can yield hundreds of dollars in additional value over the course of a year. It’s one of the reasons that it so popular.

As always, remember that is not a good idea to carry a balance on a card.

You might earn plenty of cash back. But, any interest charges are likely to negate the cash back earned.